Mumbai | June 2025 –

Mumbai | June 2025 –

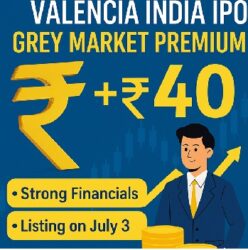

Valencia India Limited is gaining momentum ahead of its IPO launch, thanks to a potent combination of high operating margins, strong ROE, and low leverage. The IPO, which opens on June 26, is supported by an impressive GMP of ₹40, reflecting bullish investor sentiment.

🧾 IPO Details:

- Issue Size: ₹48.95 crore

- Price Band: ₹95–₹110

- Lot Size: 1,200 shares

- Opening/Closing: June 26–30

- Listing: July 3 on BSE SME

- Registrar: KFin Technologies

📊 Financial Overview:

Valencia has delivered a CAGR of over 30% in revenue and over 100% in PAT over three years. It closed FY24 with:

- Revenue: ₹7.11 crore

- PAT: ₹1.94 crore

- EBITDA: ₹3.07 crore

- ROE: 21% | Debt-to-Equity:16

Such metrics place Valencia well ahead of many peers in the SME infrastructure segment.

🏢 Business Use of Funds:

Funds raised will be directed toward premium villa development, reinforcing the company’s strategy of delivering high-end real estate solutions in urban growth zones.

📢 Market Buzz:

Analysts are optimistic, citing strong fundamentals, efficient project delivery, and clarity on fund utilization. The ₹40 GMP suggests high demand across both retail and HNI categories.

“This is a well-structured IPO. Valencia is not just profitable—it’s scalable,” said a sector expert.

Conclusion:

Valencia India offers a solid investment case, with its clean finances, niche focus, and proven execution. The strong GMP only adds to the listing appeal.

Newspatrolling.com News cum Content Syndication Portal Online

Newspatrolling.com News cum Content Syndication Portal Online