Marcellus Investment Managers Highlights Key Benefits of Investing in Global Equities

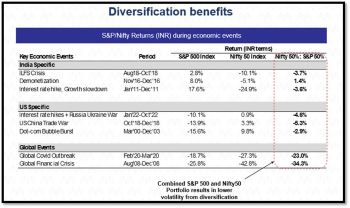

Bengaluru, 18th December, 2024: Marcellus Investment Managers, renowned for its Portfolio Management Services, today unveiled insights on global equity trends, dispelling misconceptions around global investing and emphasizing the importance of diversification. Data presented revealed that from 2004 to 2024, a balanced 50:50 Indo-American portfolio could have grown 17x in INR terms, delivering superior risk-adjusted returns while managing volatility. This underscores the role of developed market equities, especially in the U.S., as a stabilizing complement to India’s growth-driven equity story.

The Global Compounders Portfolio (GCP), a key offering from Marcellus, focuses on investing in companies with deep economic moats, robust financials, and long-term growth potential. Marcellus GCP companies play on global megatrends, T.I.D.E – (T)ECHNOLOGICAL DISRUPTION, (I)NDUSTRIAL REVIVAL, (E)ARNINGS DIVIDE + (E) XTREME FINANCIALIZATON and (D)EMOGRAPHY to deliver superior returns. By combining the best-performing markets globally, such as the U.S., with Marcellus’ research-driven approach, GCP enables Indian investors to achieve sustainable compounding while minimizing risks. A 50:50 GCP-MeritorQ portfolio, for instance, has demonstrated near 2x growth since October 2022, showcasing the benefits of blending global and domestic assets for optimal risk-adjusted returns.

Pramod Gubbi, Co-founder, Marcellus Investment Managers, said: “Global investing is not about replacing India but complementing it. Diversification across geographies provides resilience to market volatility while addressing global currency and liability challenges. Winners rotate, and portfolios must evolve to capture opportunities globally.”

Adding to this, Arindam Mandal, Head of Global Equities, Marcellus Investment Managers, stated:

“India’s growth story remains compelling, adding global equities, particularly in developed markets, offer innovation, scale, and stability. Our strategies, like the Global Compounders Portfolio (GCP), allow investors to access high-growth businesses worldwide while reducing portfolio volatility.”

A key focus of the research was addressing the “Three Biggest Fallacies Related to Global Investing” that deter investors from pursuing international opportunities. Marcellus highlighted that while India’s markets have strong potential, global diversification is essential to hedge risks, capitalize on innovation-led growth, and match rising dollar-based liabilities like education and travel. The U.S. markets, despite perceptions of slower GDP growth, have consistently outperformed over the long term due to innovation, robust R&D spending, and an ecosystem that attracts global talent.

Marcellus’ insights reaffirm that global investing is important for Indian investors seeking stability, diversification, and long-term wealth creation in an increasingly interconnected world.

Newspatrolling.com News cum Content Syndication Portal Online

Newspatrolling.com News cum Content Syndication Portal Online